SSE and Innogy’s boards have agreed to merge their retail operations. The news comes as SSE posted half year results which showed further customer losses.

SSE and Innogy’s boards have agreed to merge their retail operations. The news comes as SSE posted half year results which showed further customer losses.

The deal is subject to shareholder and regulatory approvals but SSE said it aimed to complete the transaction by end of 2018 or early 2019. SSE will seek shareholder approval by 31 July 2018. Its shareholders will own around 66% of the merged entity.

Innogy will hold the remainder and will seek board approval by the end of this year. If SSE shareholders veto the deal, it may have to pay Innogy a £60m break fee.

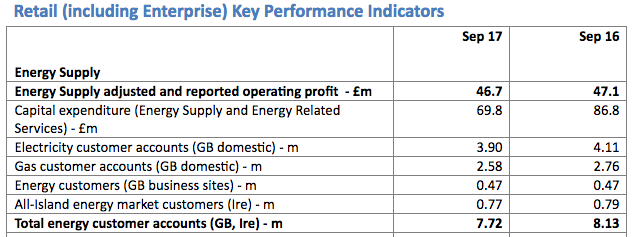

As of end of September this year, the two firms had around 11.5m customers combined, although at current rates of attrition may dip below 11m by the time any deal is done.

Posting half year results, SSE lost 400,000 customers and reported profit before tax of £402.2m, down from £675m the prior year.

Related stories:

SSE customer losses accelerate

Eon’s sales hit by fierce competition as policy intervention and Brexit loom

Shell enters UK electricity market

Swedish giant Vattenfall enters UK business energy market

British Gas business energy supply profits wiped out

Power prices to remain low to 2020: Moody’s

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

Hi just to let you npower told their staff merger would be good for them now 10 days after that they have been told meter readers are to be typed out after Xmas really good for a merger wonder if sse meter readers are getting tuped as well