Car manufacturers are starting to become aggregators of flexibility, helping grid operators balance the power system by using car batteries and smart charging systems.

Car manufacturers are starting to become aggregators of flexibility, helping grid operators balance the power system by using car batteries and smart charging systems.

But some power grid operators fear that the uptake of EVs could happen much faster than predicted – and potentially all at once – posing serious network management challenges.

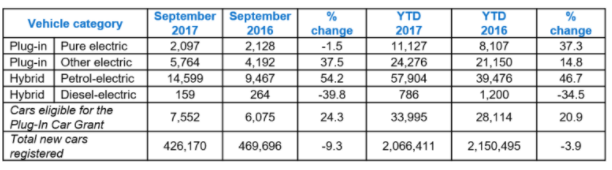

Electric vehicles remain a fraction of UK car sales, currently around 2% of new registrations. But sales are rising, battery costs are falling, range is improving and manufacturers and governments are making clear their intent.

Predictions of cost parity with fossil-fuelled cars put the tipping point somewhere in the mid 2020s. But it is notoriously difficult to gauge the pace of change.

Hazard perception

“It might be all or nothing, suddenly somebody hits the on button and we go from 100,000 [EVs] to millions almost overnight. Are we going to be ready for that?”

The network, along with other distribution network operators (DNOs), is conducting trials under Ofgem’s innovation allowances to try to work out optimal ways of managing increasing demands on local networks.

But, said Collinson, “within trials you have a controlled environment, you can fix things. In a live environment, you only have one opportunity to get it right. That is what keeps me awake at night”.

Taking part in a panel session at Western Power Distribution’s Future Networks conference, Collinson said the impact of EVs on evening peak demand was the primary challenge.

While other conference speakers dismissed as wide of the mark mainstream press stories around ‘not being able to charge cars while boiling a kettle‘, or ‘20 new nuclear power stations needed to charge EVs’, Collinson said it was important to set “principles” around charging from the get go.

Controlled stop

“What concerns us most is the tea time peak,” he said. “[Failure to manage that] runs the risk of building more network, because copper is copper [with finite capacity].

“The practicalities of digging up residential streets to upgrade low voltage networks on a wide scale is pretty unthinkable. So development of the smart grid is essential,” said Collinson.

“But there is spare capacity in the network, so an EV looks ideal if it is being charged after the tea time peak.”

Some level of co-ordination and control of charging is therefore necessary. “Not necessarily direct control and not intrusive; almost imperceptible from a customer’s perspective”, said Collinson.

“But you have to set that principle because trying to fix the problem retrospectively will be very difficult,” he added.

“As time goes on, we can understand how that will happen. We can learn a lot from trials, but [those lessons are] not necessarily applicable to a wholesale rollout.”

Fleet management

Western Power Distribution’s Nigel Turvey suggested carmakers or other third parties may be those that engage with EV owners around smart charging as well as other services.

He pointed to the recent Nissan-Ovo partnership around home batteries and vehicle-to-grid (V2G) services, which will use EVs to balance the grid and share revenue with owners.

Nissan has already made clear it is no longer just a car company, but an energy services company. The company’s trials with Leaf vehicles in Denmark suggest EV owners can earn €1,300 per year by using car batteries to balance the grid.

“You can see car companies acting effectively as aggregators and being that trusted party that people engage with,” said Turvey, though he added that DNOs, not traditionally customer-facing, must also “step up” engagement with customers.

Power slide

Speaking on the same panel session, Nick Brooks, head of energy at the Office for Low Emission Vehicles (Olev), said that the Automated and Electric Vehicles Bill, due to be implemented after party conferences, will ensure future EV charge points are smart and therefore controllable.

While that will enable network constraint management, Brooks said industry and policymakers “shouldn’t shy away from the fact that EVs require power”.

“We can shift charging to off peak, however EVs will require some investment in our electricity system,” he said.

“But that is offset by reduction in spend on fossil fuels. So consumers as whole should be making quite a big saving.”

Related stories:

Nissan: Carmaker signals roadmap to energy services company

Flexitricity chief: UK has enough spare power electrify every car on the road

Government finds £20m for vehicle to grid development

Greg Clark calls for automakers and energy industry to collaborate on battery storage

Nissan and Eaton to roll out commercial scale battery in 2017

Tesla: People don’t engage with energy bills, but they will have to

Ofgem: Energy flexibility will become more valuable than energy efficiency

Smart move: WPD presses go on shift to DSO

WPD agrees 1GW of battery storage connections, asks how big can market get

WPD ramps up DSR trials, calls for participants

Smart grids ‘require local control and businesses must play or pay’

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.