LCP’s Kyle Martin provides a review of the T-3 Capacity Market auction, and its implications for upcoming auctions.

LCP’s Kyle Martin provides a review of the T-3 Capacity Market auction, and its implications for upcoming auctions.

The T-3 Capacity Market (CM) auction recorded the lowest clearing price of a T-3/T-4 auction ever at £6.44/kW/yr. The LCP central forecast predicted a £7.07/kW clearing price which, to my disappointment, narrowly beat my own prediction of £5.70/kW. As did the majority of the LCP energy team – it turns out doing sweepstake with energy modellers isn’t easy.

The low clearing price comes as no surprise considering there had been a significant reduction in the capacity requirement of 5GW between the previous T-4 and this T-3 auction. Although the level of new build securing a contract dropped compared to previous years, there were also a number of significant older units that did not secure contracts.

LCP examines the key points from the T-3 auction below and discuss what to expect from the T-4 auction.

Who didn’t secure a Capacity Market agreement?

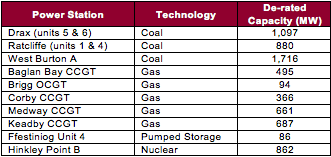

The exit of coal from the GB market took another big step forward in this auction with 3.7GW of capacity not securing agreements. The remaining Drax coal units missed out, as did all of the West Burton A units. Ratcliffe units 1 and 4 didn’t secure CM agreements while the other half of the site did. It is now entirely likely we’ll see coal off the system long before 2025.

A number of older gas units also didn’t secure agreements, increasing uncertainty over their future, with some looking to refurbish sites while others will need to secure CM agreements in the next T-4 auction if they want to continue operating. Hinkley Point B was the only nuclear unit to miss out (Hunterston B had opted out prior to the auction taking place) while Ffestiniog Unit 4 also missing out on securing an agreement.

Who secured new build CM agreements?

There were low levels of new build clearing the auction this year with only 156MW of gas (mainly reciprocating engines), 26MW of battery storage and 122MW waste to power winning agreements. Onshore wind was taking part in the CM auction for the first time with 14.5MW securing agreements – which, given its low de-rating factor, is just over 177MW of installed capacity.

532MW of Demand Side Response (DSR) cleared in the auction but when looking a bit closer at the results we see that 90.6MW of capacity awarded DSR CM agreements appear to describe themselves as ‘storage’ companies. This is interesting because if short duration batteries are located in front of the meter they would receive a de-rating factor between (10% – 20%) but by locating the same battery behind the meter they get a de-rating of 86% (by saying they are DSR) making them much more lucrative. A methodology for de-rating behind the meter units needs to be developed to avoid developers taking advantage of a loophole in the current de-rating regime.

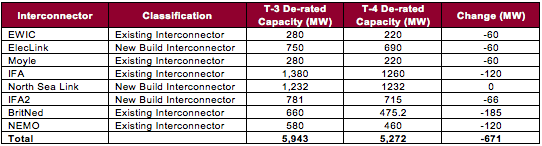

Possibly the only technology that can be seen as a ‘winner’ in this auction is interconnection, with all interconnectors clearing the auction and increasing their total share of the market by 2.7GW to 5.9GW thanks to Eleclink, IFA2 and North Sea Link all participating for the first time. However, the total de-rated capacity of these units will decrease in the next auction, with the modelling methodology that sets these de-ratings factoring in the higher penetration of interconnection and the available power in the interconnected countries. Looking further ahead there are also proposals to allow overseas generation to directly participate in the CM auction rather than interconnectors which could change interconnectors’ role in the CM.

What to look out for in the T-4 auction

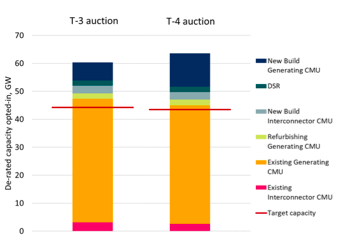

One of the significant drivers putting downward pressure on the clearing price for the T-3 auction was the reduction of the capacity requirement. For the T-4 auction this is further reduced by 0.7GW compared to the T-3 auction but the decrease in the de-rated interconnector capacity by 0.8GW virtually cancels this out. There is also a significantly higher amount of new capacity taking part in the next auction, with nearly 12GW pre-qualified compared to 6.6GW in the T-3. However, we wouldn’t expect these projects to have any significant impact on the clearing price as they would likely exit the auction before the existing units.

Total opted-in capacity for T-3 and T-4 auctions

In summary, the T-4 is shaping up to be quite similar to the T-3 auction, but participants should pay close attention to the marginal gas units that missed out on a contract this time around, as well as those looking to refurbish their power stations.

What is clear is that the amount of change that has occurred in policy and regulation over the last few years, along with increasing competition and cannibalisation of revenues in a number of key markets, will continue to flow into CM results. As the markets continue to change, particularly with the need to accommodate the large amounts of offshore wind in the pipeline, competing in the CM requires a holistic, fundamentals-driven approach.

Related stories:

Balancing market forecasting that is ‘more accurate than National Grid’

Blackouts: What happened and what are the implications?

How incoming change will impact your energy strategy

Modelling battery storage: What went wrong?

Click here to see if you qualify for a free subscription to the print magazine, or to renew.

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.