Western Power Distribution’s EV strategy details what its network can handle, costs of connections and upgrades – and some interesting plans to pay customers that charge their cars flexibly.

Western Power Distribution’s EV strategy details what its network can handle, costs of connections and upgrades – and some interesting plans to pay customers that charge their cars flexibly.

Western Power Distribution has published an electric vehicle strategy that outlines how it plans to handle increased uptake by households, businesses and local authorities.

The distribution network operator (DNO) also said it is in discussions with an airport about deploying a vehicle-to-grid system that would deliver frequency response to National Grid.

Number crunching

The strategy details WPD’s estimations of EV uptake. It thinks 217,000 chargers will be connected to its network by 2023 – up from around 7,000 a year ago.

The DNO indicates it has spare capacity to handle those kind of numbers in urban areas, with existing infrastructure – ground mounted transformers – able to provide a charge for customers every five days, provided charging is “optimised”, or managed. However, in rural areas, which use overhead networks, “options are somewhat less”.

The company plans to produce a heat map of transformer capacity, showing where capacity is available and where constraints are likely. It said aggregators could use that map to determine where they can offer flexibility solutions, or signal directly to EV owners that they will need to pay more if they want to charge at certain times via time of use tariffs.

Either way, WPD said it would not allow domestic users to blow fuses and inconvenience other customers – and will use tools to manage demand within known limits ahead of overloads.

Costs

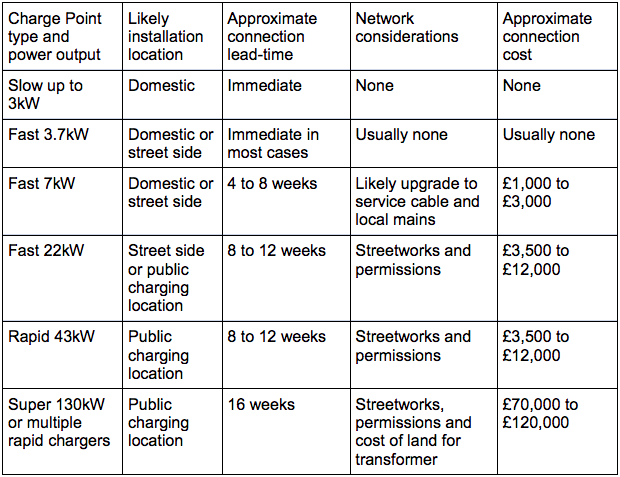

The plan outlines the cost, lead times and related works required to connect different types of chargers, ranging from nothing and immediately for slow (3kW) domestic chargers, to £120,000 and 16 weeks for a 130kW super charger or multiple rapid chargers.

It states that businesses with depot-based fleets seeking to install significant numbers of chargers – and that are likely to mostly charge at night when demand is low – will be offered alternative connections in order to mitigate costs and minimise required reinforcement.

For other workplaces and EV charging destinations, such as supermarkets and retail parks, WPD said it will make use of existing supply where it is capable of supporting the additional load, or charge for reinforcement works where required.

For on-street parking WPD said it may be able to deliver options through new street lighting.

Flexibility: for households

As well as flagging discussions with an airport over vehicle-to-grid potential, WPD trailed plans to create an ‘active’ domestic flexibility product for EV owners, “where we are able to pay directly for energy deferred under demand response demonstrated through metering”.

However, it said this would likely go through suppliers or other entities who will aggregate customers and then need to show to WPD that an action has been taken to qualify for payment.

It will also create a ‘passive’ product, where WPD pays an annual fee to EV owners that sign up for a time of use tariff, and then uses price signals to encourage customers to shift charging away from constraint periods.

Flexibility: for businesses

WPD said there is potential for depots and long stay car parks to participate in flexibility programmes – less so for rapid charging destinations.

While the DNO already procures flexibility from businesses in certain postcodes, it will also launch projects to show how flexibility could be used within EV charging to free up capacity.

It will start with simple ‘alternative connections’ approaches – where the business agrees to charge overnight and use capacity that is not required during that period, for example. It will then move to ‘active network management’ or ANM solutions, where customers react to constraint signals. WPD said it has already implemented an ANM system at a car showroom in Lincolnshire.

Whole system flexibility

WPD’s plan also hints at offering further commercial incentives to people that use local generation, storage and EV charging in ways that help the grid.

It states: “As vehicle to grid solutions and smart charging develop, we have the opportunity to make use of these flexible solutions on our network. In fact, a customer who makes use of local generation, storage and EV charging could actually reduce their impact on the network and help us avoid conventional reinforcement.”

Details here.

Related stories:

EVs: Car parks sought for V2G trials

Nissan: 2019 will be “breakthrough year” for V2G, eyes energy retail market

Nissan: Vehicle-to-grid services will not drain EV batteries

Volkswagen: Carmaker to become energy company

Mitsubishi buys into Ovo, eyes vehicle to grid

Pubs and supermarkets the new petrol stations?

Chargepoint raises £189m to fund EV charging infrastructure

BT and Eon pledge to electrify fleet by 2030

Total partners with Chargepoint to bundle energy and EVs to businesses

Bring forward zero carbon transport target, MPs urge

Octopus backs flex and EVs for growth

Energy managers to become fleet managers

BT procurement chief: Convergence is coming, energy managers must articulate impacts

Eon boss: Decarbonising power is done, now for heat and transport

EV boom no sweat, says National Grid

Flexitricity chief: UK has enough spare power electrify every car on the road

Pivot makes huge play for 2GW storage and EV charging network

‘Land grab’ for EV car parks and revenue

National Grid predicts huge solar growth, while EVs create huge storage capacity

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.