In its most recent Future Energy Scenarios, National Grid predicts up to 11m EVs on UK roads by 2030, and as many as 36m by 2040.

All National Grid’s scenarios feature smart charging to manage peak demand.

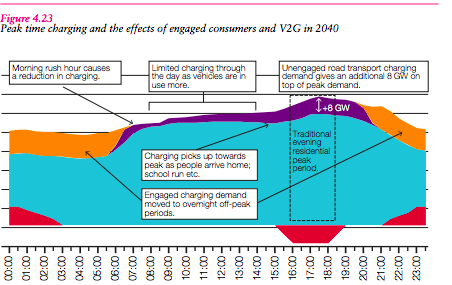

Vehicle-to-grid (V2G) services – using car batteries to balance the grid or arbitrage wholesale market prices via bi-directional chargers – will provide “useful levels of support” after 2030, said National Grid, up to 8GW by 2040 and 13GW in 2050.

When 2% = 2GW

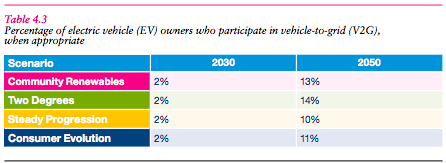

All of National Grid’s scenarios suggest just 2% of EVs will provide V2G services in 2030.

Nevertheless, in high penetration scenarios, that represents 220,000 vehicles engaged in V2G in about 10 years’ time – more than the entire volume of plug-in cars in the UK up to December 2018. Assuming a 10kW bi-directional charger, that could represent more than 2GW of system flexibility, the equivalent of Triad response.

Carmakers such as Nissan are bullish on V2G. Energy companies are also investing: EDF Energy will rollout 4,000 V2G chargers across Europe over the next three years, with 1,500 of those in the UK.

However, V2G is challenged by high costs arising from lack of scale. Competing technology standards do not help.

CHAdeMO versus CCS

Car manufacturers use different charging protocols. In general, European manufacturers use the Combined Charging System (CCS), which does not currently enable V2G, though the body promoting CCS, CharIN, recently said the standard will support V2G by 2025. Japanese manufacturers tend to use the CHAdeMO protocol – which does enable V2G services. China has its own standard, as does Tesla. How these standards either converge or can be made to work together may have a bearing on the uptake of V2G.

Battery drain?

Whether batteries designed for one function can be successfully deployed for another without suffering a higher degradation is subject to debate.

Numerous studies suggest degradation is an issue. While recent research by the University of Warwick suggests V2G could potentially extend battery life, a study by the University of Hawaii found the opposite. The two researchers later collaborated to conclude that battery life could be extended – provided the algorithms had that objective. Ultimately, they said further research is required.

Dago Cedillos, strategy and innovation lead at Open Energi, thinks the issue is overblown.

Dago Cedillos, strategy and innovation lead at Open Energi, thinks the issue is overblown.

“A lot of people are concerned about battery warranties, but to put it into context, taking your whole house off the grid during peak may only need 5% of your battery. Depending on the use case, it is not much of an additional throughput,” he says.

“There is definitely a way to agree on how we can operate [V2G services] without having a detrimental impact on the battery.”

Consumer acceptance and confidence

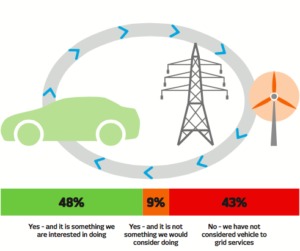

Around half (48%) of the public and private sector organisations surveyed for The Energyst’s 2019 EV Report expressed interest in providing V2G, suggesting significant appetite.

The charging, technology and energy companies interviewed for the 2019 EV Report offered mixed views on whether V2G will become a mainstream proposition. Most believe it has greatest potential within fleet and B2B markets.

The consensus is that for V2G to succeed, whoever owns the customer relationship – carmakers, energy companies or aggregators – will need strong commercial propositions backed by case studies.

EDF Energy’s Electric Vehicles Lead, Niall Riddell, thinks those case studies will start to emerge in numbers in the UK by the year end.

EDF Energy’s Electric Vehicles Lead, Niall Riddell, thinks those case studies will start to emerge in numbers in the UK by the year end.

Riddell believes the sector – including energy suppliers, OEMs and charging companies – will be able to complete “a large number of installs by the end of 2019, with commercial propositions and operational assets behind them”. He says EDF Energy hopes to be able to showcase “a healthy number of V2G case studies” within broadly the same timeframe.

First building, then grid

Honda is working with UK technology company, Moixa, on smart charging and V2G services. Moixa aims to enable both vehicle-to-building services and aggregation of EV batteries into a virtual power plant.

Honda is working with UK technology company, Moixa, on smart charging and V2G services. Moixa aims to enable both vehicle-to-building services and aggregation of EV batteries into a virtual power plant.

Its first UK site is Islington Town Hall. Chief technology officer, Chris Wright, says “even five cars will be able to offset the building’s baseload”, and by learning from consumption and driving patterns, Moixa aims to create “optimised plans” that reduce Islington’s energy bill.

Wright believes V2G “will happen when it becomes normalised and much cheaper.” He thinks battery degradation is not a V2G barrier and cites the University of Warwick study that found around 10% battery life improvement is possible.

“[The study] found what is most damaging is to charge batteries to full every time,” says Wright. “That is part of what we will demonstrate – that the machine learning platform considers status health when it is optimising the system.”

A version of this article was first published in The Energyst’s 2019 EV Report, available as a free download.

A version of this article was first published in The Energyst’s 2019 EV Report, available as a free download.

The report includes a survey of industrial, commercial and public sector organisations on EV and charging rollout plans, including their attitudes towards smart charging and vehicle-to-grid. It also contains interviews with businesses installing charging infrastructure, including Marston’s, Mitie, SES Water and UPS. There are also views from charge point operators, technology providers, consultants and technology companies, as well as energy companies.

Download the report here.

Related stories:

EVs: How UPS is driving down emissions

Oxford goes large on EVs, hybrid storage and heat pumps

Superchargers: Why the chicken crossed the road

WPD outlines EV numbers it can handle, connections and upgrade costs

EVs: Car parks sought for V2G trials

Nissan: 2019 will be “breakthrough year” for V2G, eyes energy retail market

Volkswagen: Carmaker to become energy company

Pubs and supermarkets the new petrol stations?

Chargepoint raises £189m to fund EV charging infrastructure

BT and Eon pledge to electrify fleet by 2030

Total partners with Chargepoint to bundle energy and EVs to businesses

Octopus backs flex and EVs for growth

Energy managers to become fleet managers

EV boom no sweat, says National Grid

Flexitricity chief: UK has enough spare power electrify every car on the road

Pivot makes huge play for 2GW storage and EV charging network

‘Land grab’ for EV car parks and revenue

National Grid predicts huge solar growth, while EVs create huge storage capacity

Follow us at @EnergystMedia. For regular bulletins, sign up for the free newsletter.

Did you see https://www.itv.com/presscentre/ep2week16/hard-please-oaps

If you think being behind a pensioner at the cash machine is tough just wait for the electric car in front of you with an OAP trying to charge it. It could be me!!!

Once you bring V2G into this, studies find the injected power is consumed locally with very little contributing at a national level.

V2G can be used nationally, but only via purpose built charging systems which suffer no capacity constraint. But most EVs will charge at home, so are on a constrained LV system. V2G injected here will go to charging the neighbours EV. The controller sees network headroom freed up (=V2G) so sends a “Charge” command to local EVs. The V2G is used, but lost at a national level.

This issue has been known for at least a decade but seems perpetually ignored.

EA Technology was commissioned by ENA to report on this; they found (in 2012) that £62 bn. was needed to reinforce the UK’s LV system so to be fit for EVs and HP. Or, to use ICT Smart systems (as described above). These will though need a way to force EVs to not charge.

This is why a DNO controlled disconnector is mandated in AEVA 2018 to be in each EVSE; an OFF switch to stop overloads. How the DNOs will work this (control chain) is unknown.

As far as I know, there has been no progress on resolving this issue, other than studies like WPD’s Electric Nation and the earlier My Electric Avenue; see the Closedown Report from MEA detailing the problems at LV.

But action there seems little, However NGSO does not see these practical problems, they are not Distributors.

A good pinch of salt is needed.

Thanks Steven, we’ll be posting more from DNO perspective on this topic.

All the best,

Brendan

Hi Brendan,

Great article. Are you aware of the Cenex report released last week on this topic? https://www.cenex.co.uk/energy/vehicle-to-grid/

I always thought the main gap around V2G was understanding the realistic revenue streams. This seems to give a comprehensive and realistic view on what that is likely to look like. What is your view on it? How does this align with Energyst’s own views?

Hi Chris,

Comprehensive report – definitely provides a contrast to some of the potential revenue figures touted by V2G proponents. ~£400/annum for cars that are plugged in 75% of the time isn’t huge, given cannibalisation effect on FFR likely to drag that down. Nissan has previously suggested ~€1,300 per annum via V2G, Nuvve ~€1,800, with caveats that amount does not accrue to the end user, is application specific and based on trials in Denmark. Do you think businesses will bother with the additional investment for those kind of returns?